Less than 13% of directors of 1,500 biggest companies are female

May 11, 2017 by: Sarah Gordon and Kana Inagaki

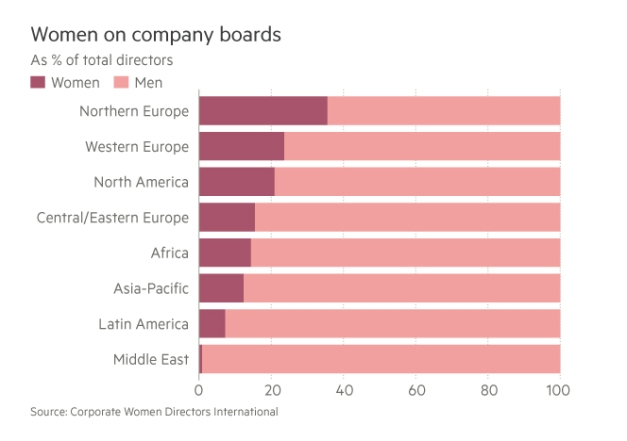

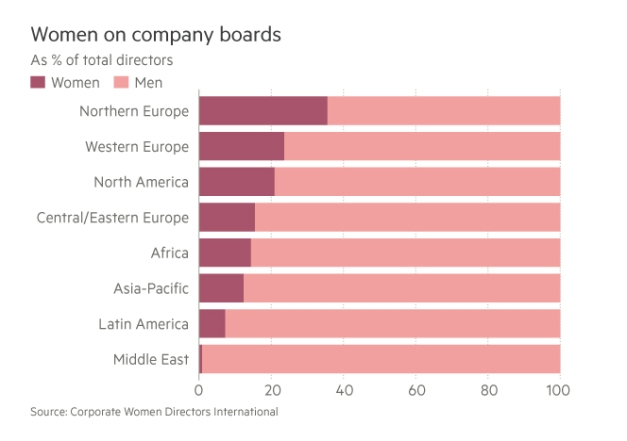

Women hold just one in eight seats on the boards of Asia’s largest public companies, a level that puts them behind peers in Europe and North America despite the region’s economic growth and increasingly mature stock markets.

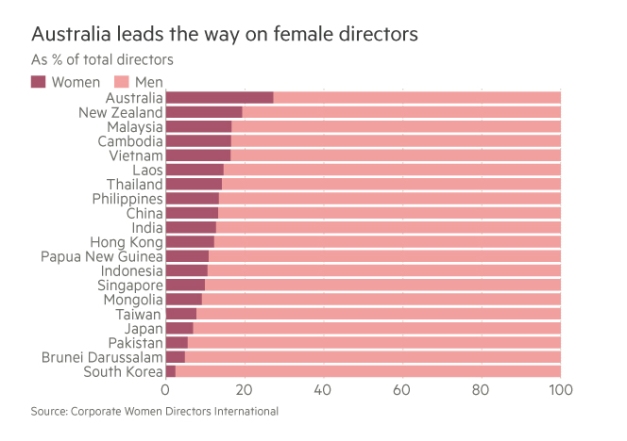

In the 1,557 largest listed companies in 20 Asia-Pacific countries, measured by market value, women account for just 12.4 per cent of board seats, according to Corporate Women Directors International, a Washington-based research group.

Asia-Pacific lags behind Europe, where women hold 30 per cent of board seats at the top 500 companies, and North America, where just over a fifth of board members at the 500 largest public companies are women, according to the research. In Africa, women hold 14.4 per cent of board seats at the 300 largest listed companies.

The low levels of representation of women in top positions in boardrooms across Asia has been blamed in part on ingrained corporate norms, as well as practices of extremely long working hours and childcare burdens that still fall on mothers.

But the lack of progress is now seen by some executives as threatening the region’s attempts to improve governance and develop meritocratic corporate structures. The majority of Asia-Pacific companies with women on the board still only have a token representation of a single female director.

“While there is global momentum — largely driven by Europe — to increase the presence of women board directors globally, Asia-Pacific companies are being left behind in moving women to corporate leadership roles,” says Irene Natividad, CWDI chair. The report will be released on Friday in Tokyo at the Global Summit of Women. “The irony is that this region has a wealth of highly educated women, many with strong business experience, who were equal contributors to the region’s explosive economic growth,” she added.

“The irony is that this region has a wealth of highly educated women, many with strong business experience, who were equal contributors to the region’s explosive economic growth,” she added.

“The irony is that this region has a wealth of highly educated women, many with strong business experience, who were equal contributors to the region’s explosive economic growth,” she added.

“The irony is that this region has a wealth of highly educated women, many with strong business experience, who were equal contributors to the region’s explosive economic growth,” she added.

Wide differences exist between countries in the region. In Australia, women hold 27.2 per cent of board seats at the 100 largest public companies, more than twice the regional average, and in New Zealand they hold 19.3 per cent. But only 14 out of South Korea’s 100 largest listed companies have any female directors.

Tim Payne, chair of the Hong Kong steering committee of the 30% club, which campaigns for more senior corporate women, says governments, and particularly securities regulators and listing committees, should play a role in encouraging future progress.

Hong Kong ranks ahead of many Asian rivals but behind the developed markets it compares itself to. The number of blue-chip company boards with no women members has halved in five years but that still leaves a fifth of companies led entirely by men.

“Diversity is one of the hallmarks of good governance and therefore of a leading stock exchange,” Mr Payne says. “The future reputation of markets like Hong Kong will depend on making progress on these issues.”

But only eight out of the 20 countries in the Asian survey have strategies in place to increase the number of women directors.

India adopted a quota of at least one woman on the board of all publicly listed companies in 2013. Companies were slow to comply, however, amid complaints of that the move was tokenism that did little to change India’s male-dominated, “old-boy” network corporate culture. Among those that moved slowest were state-owned companies in heavy industry. But the law has still had some impact. According to a report by the Credit Suisse Research Institute, the share of women on Indian boards has risen from 5.5 per cent in 2010 to 12.7 per cent now, closing the gap with a global average of 14.7 per cent. In family-owned companies, the female board member has typically been the wife or daughter of the controlling shareholders.

But the law has still had some impact. According to a report by the Credit Suisse Research Institute, the share of women on Indian boards has risen from 5.5 per cent in 2010 to 12.7 per cent now, closing the gap with a global average of 14.7 per cent. In family-owned companies, the female board member has typically been the wife or daughter of the controlling shareholders.

But the law has still had some impact. According to a report by the Credit Suisse Research Institute, the share of women on Indian boards has risen from 5.5 per cent in 2010 to 12.7 per cent now, closing the gap with a global average of 14.7 per cent. In family-owned companies, the female board member has typically been the wife or daughter of the controlling shareholders.

But the law has still had some impact. According to a report by the Credit Suisse Research Institute, the share of women on Indian boards has risen from 5.5 per cent in 2010 to 12.7 per cent now, closing the gap with a global average of 14.7 per cent. In family-owned companies, the female board member has typically been the wife or daughter of the controlling shareholders.

Malaysia imposed a quota of 30 per cent women directors, which has resulted in the proportion of female board members at its largest companies more than doubling from 7.6 per cent in 2011 to 16.6 per cent.

In Japan, one of Prime Minister Shinzo Abe’s early goals in his “womenomics” programme was for women to occupy 30 per cent of all management positions by 2020.

The government has since scaled back its target to 10 per cent, although that is still seen as ambitious with the share of women executives at listed Japanese companies stuck at just 3.4 per cent. Optimists, while acknowledging that progress is slow, point to the fact that the ratio of women in executive positions was just 1.8 per cent in 2013 when Mr Abe became prime minister.

Kathy Matsui, Goldman Sachs chief Japan strategist, questions whether the 10 per cent target is realistic given Japan’s corporate culture.

“There are countries that have quotas. Could Japan contemplate that? Yes — and there are those that have raised that for discussion. The problem is that even in countries like Norway where there is greater board diversity due to the introduction of quotas, there haven’t been parallel shifts within managerial ranks,” says Ms Matsui. The Abe administration, in the fourth year of the “womenomics” campaign, is now seeking to create peer pressure within corporate Japan.

The Abe administration, in the fourth year of the “womenomics” campaign, is now seeking to create peer pressure within corporate Japan.

The Abe administration, in the fourth year of the “womenomics” campaign, is now seeking to create peer pressure within corporate Japan.

The Abe administration, in the fourth year of the “womenomics” campaign, is now seeking to create peer pressure within corporate Japan.

“It is similar to the way that Japan is trying to enforce better corporate governance, [through] peer pressure. It is slower than a quota, but it may be more effective in creating the necessary culture shift,” said Goldman’s Ms Matsui.

Keine Kommentare:

Kommentar veröffentlichen